Consumer behaviour is always changing, leading to new eCommerce trends that require brands to adapt and stay relevant. A recent trend that’s gaining momentum is Buy Now, Pay Later (BNPL) and it’s altering the way shoppers are buying products and services.

In this blog, we’ll investigate what eCommerce brands need to know about the buy now, pay later phenomenon and how it can be used to enhance your business.

What is buy now, pay later?

BNPL refers to a purchasing method that lets consumers buy goods and pay for them in instalments. This kind of finance option has been around for years and it’s risen in popularity among millennials and Generation Z for its convenience and the level of control it provides on purchases.

The COVID-19 pandemic created a boom for BNPL, with a 52% spike in users in 2020. The uncertainty of work and life may have led to consumers wanting to feel they had more say over how much to pay for products. BNPL empowered them to make this decision.

Who are the most popular buy now, pay later providers?

Klarna

Klarna is one of the most recognised BNPL apps and is recommended for making large purchases because it provides up to 36 months of financing and it has a lot of versatility across online and offline retailers.

The three payment offers provided are:

- Pay in 30 days: Shoppers make a payment 14 -30 days after purchase.

- Financing: Users have the option to pay over 6 – 36 months.

- Pay in 3: Shoppers can spread the cost of a product across 3 instalments.

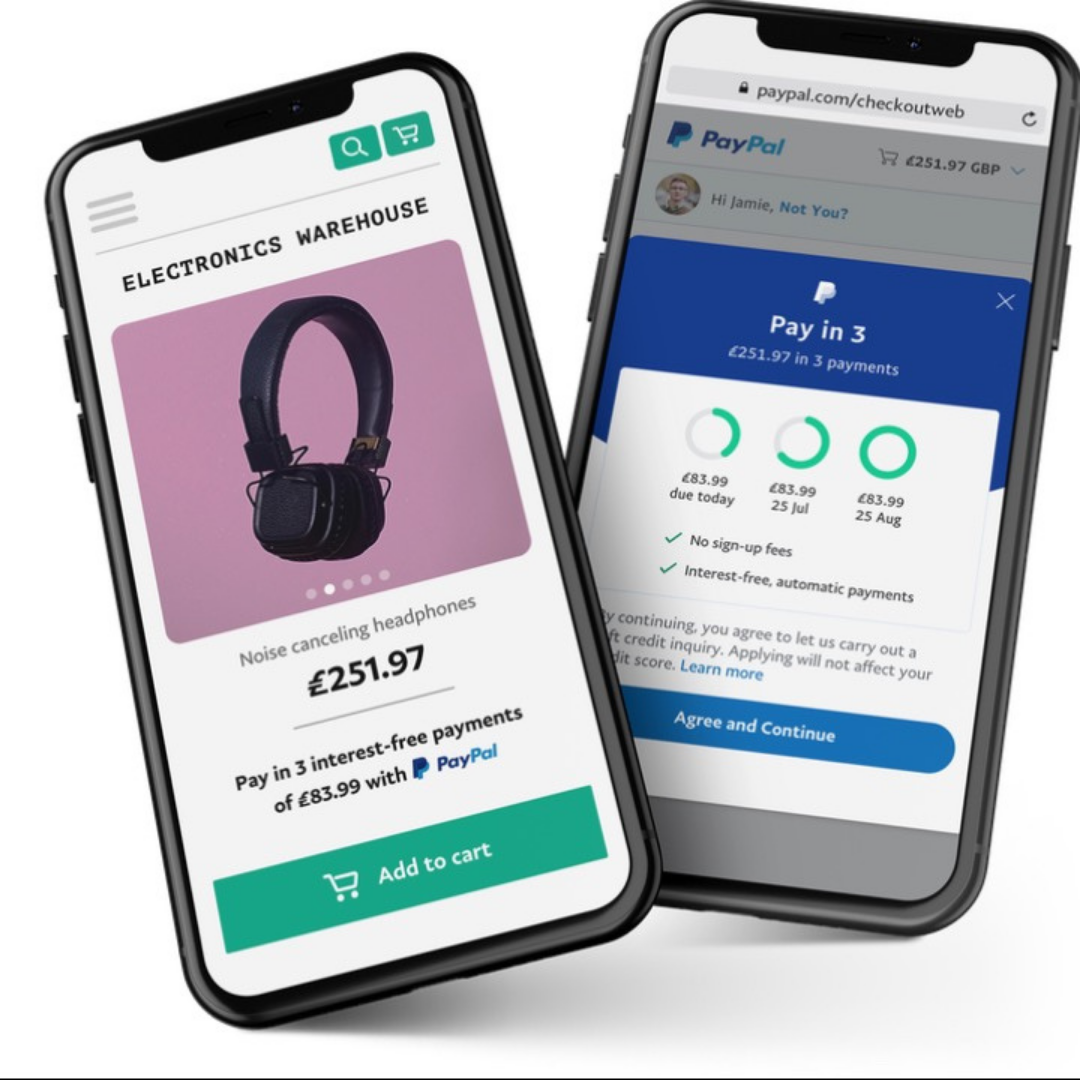

PayPal Pay in 4

PayPal’s own BNPL feature has instant appeal because the company is well-known, and it can be integrated with multiple vendors.

It works by splitting the purchase of an item over 4 payments. One down payment is made at the time of sale and the other three every two weeks.

Features

- Interest-free payments

- Payments are instantly approved

- Only available to merchants that accept PayPal

- The maximum purchase option is up to $1500 (£1100)

Affirm

Affirm is a BNPL app that doesn’t charge interests and provides a flexible payment schedule with options that range from 3 monthly payments to 12 monthly payments.

With omnichannel solutions and partnership programme that provides access to premium shoppers, brands that use Affirm can increase customer retention and provide a better shopping experience.

Afterpay

If you’re marketing to younger customers and students, Afterpay may be the right BNPL app for your business. This is because it offers smart credit limits that ensure people can stay within their budget when making payments.

Strong security measures and a customer refund policy also showcase a high level of trust, indicating Afterpay is a good payment option for shoppers.

What are the benefits of BNLP apps for eCommerce brands?

- Helps remove barriers to making a purchase for shoppers and increases overall sales.

- Increases Average Order Value (AOV) by encouraging consumers to make larger purchases.

- Offers a new revenue stream option and provides consumers with more options.

- Enhances user experience in an eCommerce store.

- Provides a higher Customer Lifetime Value (CLV) by giving shoppers more control on what and how they buy.

Create your eCommerce strategy with Trio Media

At Trio Media, we’re focused on staying on top of new eCommerce trends and advising brands on how to create a winning strategy.

If you have any questions about our eCommerce marketing services, get in touch with us on 0113 357 0440.